Calgary, AB - Press Release for Immediate Distribution.

Landlords optimistic as Alberta residential rental rates show signs of stabilization. Recent data compiled by Hope Street Management Corporation suggests that slumping rental rates in Alberta’s major centres appear to have “bottomed-out” indicating a shift in the province’s depressed rental real estate markets.

The rental markets of Alberta’s major centres have seen drastic declines in rental rates and increasing vacancies over the past 24 - 36 months. The number of available, advertised rental properties peaked in recent months with over 8200 available listings in Calgary and 5200 in Edmonton (December 2016). Both figures represent all time record high number of rental vacancies. Vacancy rates as published by the Canada Mortgage and Housing Corporation have suggested that the vacancy rates in Alberta are averaging approximately 8% in each of the major cities, while recent research conducted by the author of this paper has revealed that up to 37% of available rental listings are unoccupied in Calgary and 21% are empty in Edmonton.

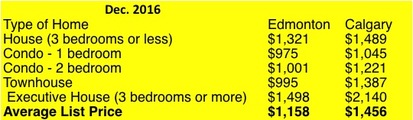

A review of the past 6 months rental rates in Edmonton and Calgary suggest that downward rental price trends have stabilized. Rental rates do not appear to be decreasing any further from their current low points.

Click Here to view a high resolution version of this Edmonton Rental Rate Chart.

Click Here to view a high resolution verison of this Calgary rental rate chart.

The particulars of the data referenced is further detailed below. Edmonton’s current average rental rate of $1161 per month appears to have been largely stable in the past 90 days, and Calgary current average rental rate of $1469 per month shows a slight trend upwards.

The statistics contained in this report are primarily focused on rental data from private landlords. For the purposes of this report; “private” landlords may be defined as persons who own 1 - 3 residential rental properties which may include some portion of their primary residence such as a laneway suite, basement rental apartment, etc. The private landlord does not employ any other person in a conventional employee relationship wherein payroll deductions are made and a bonafide property management job description exists. Conversely, the private landlords surveyed overwhelmingly hold outside, full time, employment and treat their real estate investing as a part-time pursuit.

According to Shamon Kureshi, Hope Street’s President & CEO;

“Private landlords in Alberta have endured a rough ride over the past 24 months, rental rates dropped while vacancy rates climbed rapidly.”

However, Kureshi went on to say;

“Leading indicators suggest that there is cause for optimism in 2017 as rental rates appear to have bottomed out, and can only go in one direction from this point forward - up.”

On the topic of causality, Kureshi suggests that the levelling off of rental rates was a function of several factors in consort;

“…the feedback from our renters seems to suggest that there are several factors at play to cause a market shift, including: an improved outlook on oil and gas in the province, less new rental properties coming online, and a slowing of outward migration away from the province.”

This report was compiled by the team at Hope Street Management Corporation and was primarily based on raw data from Hope Street’s rental operations in the past 90+ days, data from cooperating ILS (Internet Listing Service) websites, interviews with stakeholders, and anecdotal data.

Hope Street is an industry leading team of property management professionals currently serving Edmonton and Calgary with new a office opening in downtown Vancouver shortly. Hope Street has 75 team members and directly manages the tenancies of about 3600 people.

For media inquiries:

Shamon Kureshi, President & CEO

Hope Street Management Corporation

5th Floor - Parkside Place

Calgary AB, T2R 1J3

403-520-5220